CFTC Silver Revelations

Last week we had Silver shocking news from the Commodities Futures Trading Commission (CFTC) that silver futures pricing may have been manipulated:I do believe that there have been repeated attempts to influence prices in the silver markets,” Mr Chilton said on Tuesday at a meeting in Washington. “There have been fraudulent efforts to persuade and what I consider deviously control that price.With this news and revelations being priced into the markets, Silver appears poised for a new movement upwards. The author reviews the silver price and the status of his Six Silver Stocks recommendation made on September 17th, 2010.

Silver Price Movement Recently

The Kitco chart following displays the last Silver price at the end of the day Friday October 29th as $24.75 USD.Click to enlarge:

Figure 1: Silver Daily closes at $24.75 Oct. 29th, 2010.

Examining the silver movement using the SLV Silver ETF as a proxy for the price of silver for the last month in the chart following we see the distinct formation of a bowl or cup shape, circled in blue.

Click to enlarge:

Figure 2: Silver Chart with Bowl formation. Silver appears poised for break upwards.

In technical trading circles, the bowl or cup shape is seen as bullish, as a continuation of an up trend indicator. Looking further back to summer, in the following chart of the SLV, we see that the silver price started the up trend on or about August 22nd, 2010.

Click to enlarge:

Figure 3: Silver moves since August 23rd, 2010. All indicators shown are bullish. The RSI is turning upwards. The price bowl looks poised for a break upwards. The volume is increasing, supporting the price moves. The MACD and STO are curling upwards.

Figure 3: Silver moves since August 23rd, 2010. All indicators shown are bullish. The RSI is turning upwards. The price bowl looks poised for a break upwards. The volume is increasing, supporting the price moves. The MACD and STO are curling upwards.Since that date, the price action has been straight upwards until mid October. On about October 15th, the upwards movement stopped and the prices traced out the afore mentioned bowl shape. With the CFTC news last week, it now looks as if the Silver price may have finished tracing the bowl and may be ready to resume its upwards movement in November.

Six Silver Stocks Status

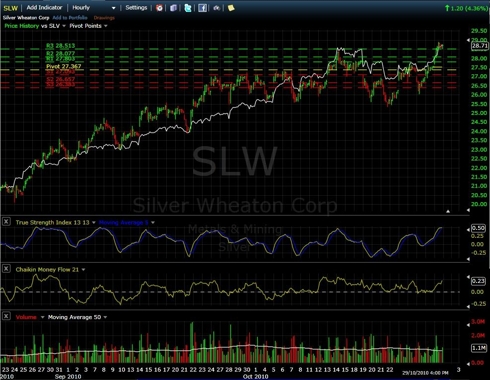

Following are the charts of the stock prices since August 23rd, 2010, for my six Silver stocks recommendation and comments. Each chart is compared to the price action of the SLV ETF, the silver white tracing.Silver Wheaton - SLW (Click to enlarge)

Figure 4: Silver Wheaton - SLW is tracking Silver's price.

Silver Wheaton just seems to be moving along the track in line with the price of silver. SLW did give a bullish pop of 5% this past Friday. SLW reported record earnings of $53 million USD, in August, 2010, up 200%. It will be interesting to see what this November's quarterly report will bring, with the peaking Silver prices.

Hecla Mining - HL (Click to enlarge)

Figure 5: Hecla Mining - HL is tracking Silver's price.

Hecla's share price jumped over Silver in early September, 2010 and has stayed up since. HL reported its third quarter last week with an increase of 30% in cash flow versus 2009.

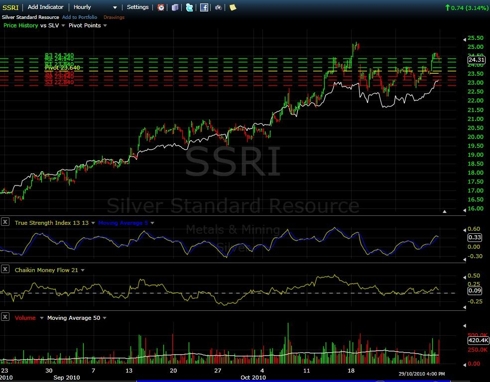

Silver Standard Resources - SSRI (Click to enlarge)

Figure 6: Silver Standard Resources - SSRI is tracking Silver's price.

Silver Standard Resources' share price jumped over Silver in mid-October and has stayed buoyant since then. Last Friday, SSRI announced the sale of its huge Snowfield and Bruce Jack properties. SSRI will still control about 50% of the value of these properties in the new company, Pretium Resources, formed by their former CEO Robert Quartermain. Perhaps this is a mechanism that will be able to unlock the precious metals values in the two large properties.

US Silver Corporation - USSIF.PK (Click to enlarge)

Figure 7: US Silver Corp USSIF is leveraging Silver's price.

US Silver Corporation displays the characteristics of a junior miner's ability to leverage the price of silver. USSIF has stayed consistently above the silver price line and the gap higher is increasing. USSIF has just completed a $7 million dollar financing to refurbish a shaft in their Coeur mine, in order to increase production. USSIF reported its 3rd quarter in mid-October, and production missed targets due to a contractor fatality in June, 2010.

Genco Resouces - GGCRF.PK (Click to enlarge)

Figure 8: Genco Resources - GGCRF is leveraging Silver's price.

Genco Resources is an undervalued Silver producer in Mexico, that was just offered a merger by Silvermex Resources (SLVXF.PK). Last Friday, ISS Proxy Services recommended the merger going forward, causing the movement in the share prices.

Canadian Zinc - CZICF.PK (Click to enlarge)

Figure 9: Canadian Zinc - CZICF is leveraging Silver's price.

Canadian Zinc made a large movement upwards in mid-September with its deep resource extension drilling. CZICF is the owner of the old Hunt Brothers' Silver, Zinc and Lead Prairie Creek mine in northern Canada. CZICF is drilling to prove up further resources and is awaiting approval of its water permit, expected in 2011. CZICF just reported last week on its Environmental Assessment and drilling being finished for the season.

Silver Summary

Silver appears poised to resume moving upwards this fall. The fundamental reasons for Silver to become more valuable was just given a boost by the CFTC revelations. Major Silver miners such as SLW, HL, and SSRI are moving in time with Silver in addition to their own value creation. Smaller Junior Silver stocks such as USSIF, GGCRF and CZICF are leveraging the price of Silver with their movements upwards. The Silver status is definitely satisfactory.Disclosure: The author is long Silver mining equities.

Important Disclaimer: The information and opinions contained within this document reflect the personal views of the author and should be viewed as food for thought and amusement only. The author may from time to time have a position in any of the securities mentioned. There are no guarantees of the accuracy, reliability or completeness of the information contained herein. Independent due diligence and discussions with one’s own investment and business advisor is strongly recommended. These writings are not to be construed as an offer or solicitation with respect to the purchase or sale of any security or as an endorsement of any product or service. We do not request or receive compensation in any form in order to feature companies in this publication. It is prohibited to copy or redistribute this document to any type of third party without the express permission of the author. This document may be quoted, in context, provided proper credit is given.

Hey Marco, I sold out my 21000 shares of CZICF after National INflation newsletter recommended the stock and it flew up over the next few days. Do you think that the new holders will have the paitence to wait 1-2 years for this to play out?? I would'nt mind getting back in when/if the price settles down. I have been in and out of this and haven't made much overall.

ReplyDeleteHi,

ReplyDeleteI hold CZICF as disclosed.

The main thing this stock needs is the water permit, which should be decided in early 2011.

Then the stock is worth a lot more.

My experience for max gains, is the wait. One can sell on a move upwards, but one never knows if this is only volatility or it is the real move to a new level.

Marco G.

nice article regarding silver stocks. I was fortunate enough to get into USSIF a few months ago and have made 200%+ and it's just a start, this is worth $4~6 comparative to other mining stocks.

ReplyDeleteGLTA

I like your article and it really gives an outstanding idea that is very helpful for all the people on web.

ReplyDelete